Advertisement

-

Published Date

July 22, 2020This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

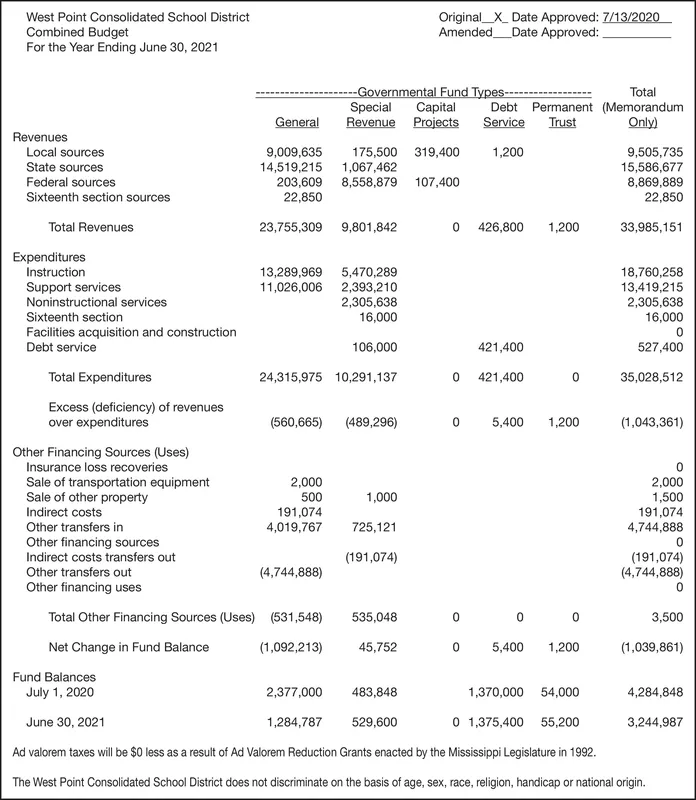

Original_X_ Date Approved: 7/13/2020 Amended_Date Approved: West Point Consolidated School District Combined Budget For the Year Ending June 30, 2021 --Governmental Fund Types-- Capital Revenue Projects Debt Service Total Permanent (Memorandum Only) Special General Trust Revenues Local sources State sources Federal sources Sixteenth section sources 9,009,635 14,519,215 1,067,462 203,609 8,558,879 107,400 22,850 175,500 319,400 1,200 9,505,735 15,586,677 8,869,889 22,850 Total Revenues 23,755,309 9,801,842 426,800 1,200 33,985,151 Expenditures Instruction Support services Noninstructional services 13,289,969 5,470,289 11,026,006 2,393,210 2,305,638 16,000 18,760,258 13,419,215 2,305,638 16,000 Sixteenth section Facilities acquisition and construction Debt service 106,000 421,400 527,400 Total Expenditures 24,315,975 10,291,137 421,400 35,028,512 Excess (deficiency) of revenues over expenditures (560,665) (489,296) 5,400 1,200 (1,043,361) Other Financing Sources (Uses) Insurance loss recoveries Sale of transportation equipment Sale of other property Indirect costs Other transfers in 2,000 500 191,074 4,019,767 2,000 1,500 191,074 4,744,888 1,000 725,121 Other financing sources Indirect costs transfers out Other transfers out (191,074) (4,744,888) (191,074) (4,744,888) Other financing uses Total Other Financing Sources (Uses) (531,548) 535,048 3,500 Net Change in Fund Balance (1,092,213) 45,752 5,400 1,200 (1,039,861) Fund Balances July 1, 2020 2,377,000 483,848 1,370,000 54,000 4,284,848 June 30, 2021 1,284,787 529,600 0 1,375,400 55,200 3,244,987 Ad valorem taxes will be $0 less as a result of Ad Valorem Reduction Grants enacted by the Mississippi Legislature in 1992. The West Point Consolidated School District does not discriminate on the basis of age, sex, race, religion, handicap or national origin. Original_X_ Date Approved: 7/13/2020 Amended_Date Approved: West Point Consolidated School District Combined Budget For the Year Ending June 30, 2021 --Governmental Fund Types-- Capital Revenue Projects Debt Service Total Permanent (Memorandum Only) Special General Trust Revenues Local sources State sources Federal sources Sixteenth section sources 9,009,635 14,519,215 1,067,462 203,609 8,558,879 107,400 22,850 175,500 319,400 1,200 9,505,735 15,586,677 8,869,889 22,850 Total Revenues 23,755,309 9,801,842 426,800 1,200 33,985,151 Expenditures Instruction Support services Noninstructional services 13,289,969 5,470,289 11,026,006 2,393,210 2,305,638 16,000 18,760,258 13,419,215 2,305,638 16,000 Sixteenth section Facilities acquisition and construction Debt service 106,000 421,400 527,400 Total Expenditures 24,315,975 10,291,137 421,400 35,028,512 Excess (deficiency) of revenues over expenditures (560,665) (489,296) 5,400 1,200 (1,043,361) Other Financing Sources (Uses) Insurance loss recoveries Sale of transportation equipment Sale of other property Indirect costs Other transfers in 2,000 500 191,074 4,019,767 2,000 1,500 191,074 4,744,888 1,000 725,121 Other financing sources Indirect costs transfers out Other transfers out (191,074) (4,744,888) (191,074) (4,744,888) Other financing uses Total Other Financing Sources (Uses) (531,548) 535,048 3,500 Net Change in Fund Balance (1,092,213) 45,752 5,400 1,200 (1,039,861) Fund Balances July 1, 2020 2,377,000 483,848 1,370,000 54,000 4,284,848 June 30, 2021 1,284,787 529,600 0 1,375,400 55,200 3,244,987 Ad valorem taxes will be $0 less as a result of Ad Valorem Reduction Grants enacted by the Mississippi Legislature in 1992. The West Point Consolidated School District does not discriminate on the basis of age, sex, race, religion, handicap or national origin.